MENU

- About Us

- Products & Market Data

- Listing & Issuer Services

- Education & Investor Services

- Regulations & Governance

- CDS

- Contact

investor education

- Home

- •

- Education & Investor Services

- •

- investor education

- •

- Investor Education FAQs

Investor Education Frequently Asked Questions (FAQ's)

The Stock Exchange of Mauritius (SEM) provides a regulated market place where securities of listed companies and other financial products can be traded by means of innovative, world-class systems and services. SEM also provides listed companies with a platform to raise capital through rights issues and/or new issues to finance their growth and expand their business. SEM was incorporated in Mauritius on March 30, 1989 under the Stock Exchange Act 1988, as a private limited company responsible for the operation and promotion of an efficient and regulated securities market in Mauritius. Since 06 October, 2008, SEM became a public company. The activities of the SEM are regulated by the Financial Services Commission.

Since 1989, the Stock Exchange of Mauritius has come a long way. From the teetering steps of the early days when trading took place once a week for a mere 5 minutes through the open-outcry system, when the settlement cycle of a transaction exceeded two weeks, and when the total value traded during the first six months of operations barely exceeded Rs 15 million, the SEM has today emerged as one of the leading exchanges in Africa and has been at the forefront of the change process in the exchange space on the continent. Back in 1989, the SEM started its operations with the Official Market only with five listed companies at that time and a market capitalisation of nearly USD 92 million. The size of the market has grown from a market capitalisation to GDP ratio of less than 4% in 1989 to a current market Cap/GDP ratio exceeding 95%, in an economy that has witnessed a 5% average growth rate during the last 30 years.

The Stock Exchange of Mauritius operates two markets today: the Official Market, the Development & Enterprise Market (DEM). SEM can list, trade and settle equity and debt products in USD, EUR, GBP, ZAR besides the local currency MUR. Local investors account for about 60 % of the daily trading activities, and foreign investors account for the 40 % remaining. 75 % of that local volume is generated by institutions like mutual funds, pension funds and insurance companies. 9 investment dealers operate on the Mauritius Bourse. Each investment dealer holds a license granted by the Financial Services Commission. Investment dealers are required to have at least one duly licensed representative who shall be entitled to carry out the functions of the Investment dealer.

The Central Depository & Settlement Co Ltd or CDS, is the centralised depository and clearing house for trades executed on the SEM. ie All purchased/sold shares are credited to/debited from the respective accounts upon receipt of funds from the Central Bank on the third day after execution at 10am.

Well-functioning stock markets enable economic growth and development by facilitating the mobilisation of financial resources and by bringing together those who need capital to innovate and grow, with those who have resources to invest. They do this within an environment that is regulated, secure and transparent Exchanges also seek to promote good corporate governance amongst their listed issuers, encouraging transparency, accountability and respect for the rights of shareholders and key stakeholders. However, despite playing a crucial role the link between exchanges and economic development is not widely-understood or appreciated.

Without stock markets, businesses would largely resort to borrowing huge loans which must be repaid with interests. Fortunately, businesses in both the developed and developing world can issue shares to the public, raising vast amounts of cash that doesn’t come along with a repayment burden. (public companies are under no obligation to pay dividends, especially when they incur losses). When businesses have access to such capital, they can easily expand their operations and create more job opportunities. From a national perspective, this will lower unemployment levels, and enable a government to earn move revenue from business taxes.

Stock markets provide a trading platform for governments too. Sometimes a local, state or national government may need more money to develop a community housing estate, build a water treatment plant or initiate any other public projects. Instead of increasing taxes to raise the required revenue, it can issue bonds through the stock market. When investors buy these bonds, the government is able to raise the money it needs to launch various projects that can ease the cost of living or even create jobs for locals. In the long run, this improves the economy.

Investments, whether in the financial markets or product markets (agriculture, real estate, manufacturing etc.), are a key driver for economic trade, growth and prosperity. As governments focus on creating policies –like lowering interest rates – that promote a culture of investment, stock markets are gaining prominence as a top destination for investors. Increasingly, more people are looking to invest in companies with growth potential. You don’t have to look further than Warren Buffet, one of the richest men of our times, to know that stocks create billionaires.

Stock markets provide a trading platform for governments too. Sometimes a local, state or national government may need more money to develop a community housing estate, build a water treatment plant or initiate any other public projects. Instead of increasing taxes to raise the required revenue, it can issue bonds through the stock market. When investors buy these bonds, the government is able to raise the money it needs to launch various projects that can ease the cost of living or even create jobs for locals. In the long run, this improves the economy.

For investors, stock markets are huge auction houses. Every day, investors are buying and selling their shares. This makes securities a liquid investment. When investors want to exit an investment, it is quick and easy to find a buyer. Other assets are much more difficult to sell. If you invested in an investment property, it could take time to find a buyer and get your money out. With securities, investors can find a buyer the very day. SEM comes handy for investors who wish to exit as they are given the option of exiting whenever they want to.

Given that the price of securities fluctuates up and down depending on the performance of the companies as well as other developments in the economy there is a real opportunity for investors to make a profit through buying and selling securities in the secondary market. SEM further enables investors to keep in touch with their investments remotely so they can make quick decisions in certain market conditions which needs to be acted on urgently. The general principle is very simple; one should buy a security when the price is low and sell the security when the price is high.

Outside capital growth, investors can also receive income from their investment in the form of a dividend. While not all securities offer dividends, there are those that do deliver periodical payments to investors. These payments arrive even if the stock has lost value and represent income on top of any profits that come from eventually selling the stock. Investors can hold on to their shares whilst benefiting from dividends.

SEM operates an automated trading system (ATS) developed by Securities and Trading Technology (STT), a global provider of financial market solutions and software-enabled services. SEM's ATS is a mainstream computer system designed to match buy and sell orders placed by licensed stockbroking companies. Each stockbroker has in his office a terminal front-end connected with a SEM server. The central system software consists of an electronic order book which enables market participants to post their buy and sell orders on behalf of their clients and to have their orders matched automatically. When an order is matched, the broker receives immediately a confirmation of the execution of the trade.

The new mySEM app, launched on 13th May 2022, is a Progressive Web App (PWA), delivered through the web via URL https://mysem.stockexchangeofmauritius.com and can be used on any platform (desktop and mobile) using a standard compliant browser.

The mySEM app is fully-responsive and therefore fully-optimised for all smart devices, to cater for the increasing number of existing and prospective investors accessing the mySEM app through mobiles or tablets. Hence, investors will be able to navigate on mySEM more efficiently with minimum resizing and scrolling from any smart device. At this stage, there is no need for mobile users in downloading mySEM app from an app store. Adding the mySEM app to the app stores for download, is planned for future release updates. Hence, in order to access mySEM on a mobile device, simply open the URL https://mysem.stockexchangeofmauritius.com using the mobile browser, and simply use the browser menu to save the mySEM app on the mobile home screen. As a PWA, mySEM app is therefore easily accessible through a mobile phone’s browser, and can be added to the user’s home screen.

The mySEM app aims at empowering investors to follow the market in real-time, seize market opportunities, trade in real-time, and have online access to their CDS accounts to monitor their account activity and account status. In addition to the new look and feel, mySEM also provides investors seamless access to a wide variety of market data in real time, including company specific order books, highs and lows, best bids and asks, and other relevant company-specific data. SEM’s new mySEM app also introduces interactive charting on all listed securities over different time-scales up to 12 months.

SEM operates two markets: the Official Market and the Development & Enterprise Market (DEM). The listing requirements are the following:

A company seeking a listing on the Official Market of the SEM should:

- Demonstrate an adequate trading record with published or filed accounts for the three years preceding the application for listing;

- Have an expected market capitalisation of not less than MUR 20m; and

- Issue at least 25% of its shares to the public, with a minimum of 200 shareholders, though this threshold may be phased in, with companies issuing 15% of their shares initially, increasing this proportion to 20% within three years and 25% by the end of five years.

A company seeking a listing on the Development & Enterprise Market of the SEM should have:

- Published financial statements for at least one year, which must have been prepared according to IFRS and audited according to ISA without qualification;

- A minimum market capitalisation of MUR 20m; and

- A minimum of 100 shareholders and 10% of shares in public hands.

SEM's Trading Schedule is as follows:

|

Market |

Exchange Day |

Trading Hours |

|

Official – Equity Board |

Monday to Friday |

9.00 a.m. to 14.30 p.m. |

|

Official-Odd Lot Board |

Monday to Friday |

9.00 a.m to 14.30 p.m |

|

Debt - BoM Bills/T-Bills |

Monday to Friday |

9.30 a.m to 11.30 p.m |

|

Debt - Other Govt Securities/Debt Instruments |

Monday to Friday |

9.30 a.m. to 14.30 p.m |

|

DEM – Equity Board |

Monday to Friday |

9.00 a.m to 14.30 p.m |

|

DEM – Odd Lot Board |

Monday to Friday |

9.00 a.m to 14.30 p.m |

|

Special Terms Boards |

During trading hours of specific Boards and as and when the need arises |

|

- SEMDEX

- SEMTRI

- SEM-10

- SEM-ASI

- SEMTRI-ASI

- SEM-AFRIDEX

- SEM-VWAP

- SEM-BI

- DEMEX

- DEMTRI

- SEMSI

The SEMDEX, the benchmark index, is an index of prices of all listed stocks where each stock is weighted according to its share in the total market capitalisation. It is a weighted index and each stock is weighted according to its shares in the total market capitalisation. Thus, changes in the SEMDEX are dominated by changes in the prices of shares with relatively higher market capitalisation. In its computation, the current value of SEMDEX is expressed in relation to a base period, which is chosen as the 5th July 1989, with an index of 100.

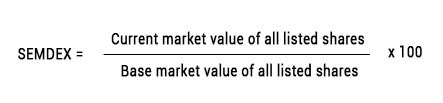

The index formula is as follows:

where the market value of any class of shares is equal to the number of shares outstanding times its market price.

The base value of listed shares is adjusted to reflect new listings, rights issues and other capital restructurings.

The Total Return Index, the SEMTRI, was launched in October 2002. Besides capturing the price movements of listed stocks, common to the already published all-share index SEMDEX, the Total Return Index, SEMTRI, incorporates the added feature of providing investors, in general, and long-term investors like pensions funds, in particular, a good measurement of total return which combines both capital gains/losses on listed stocks and gross dividends obtained on these stocks since the inception of the local stock market on 5 July 1989. Gross dividends are assumed to be re-invested in the stocks underlying the capital index, SEMDEX.

The SEM-10 index was introduced on 02 October 2014. Designed to meet international standards and provide an investible benchmark for domestic and foreign market participants. The SEM-10 comprises the ten largest eligible shares of the Official Market, measured in terms of market capitalisation, liquidity and investibility criteria. The SEM-10 Index in fact replaced the old SEM-7 Index introduced in back in March 1998. On the day of the introduction of SEM-10 Index on 02 October 2014, the opening level of the SEM-10 Index was set at the closing level of the SEM-7 index on 01 October 2014.

The SEM-ASI (SEM All Share Index) is an index that includes all shares listed on the Official Market.

The SEMTRI-ASI is a total return index that tracks the price performances of the constituents of the SEM-ASI and assumes that the dividends paid by these constituents are reinvested in the same.

The SEM-AFRIDEX tracks the performance of listed equity securities on the SEM that have a focus on the African continent (except Mauritius).The SEM-AFRIDEX was launched at 100 points and includes all listed and traded equity securities on the Official and Development & Enterprise Market that meets the index eligibility criteria.

The SEM Volume Weighted Average Price (VWAP) index is an index of volume weighted average prices of all listed and traded ordinary shares / Depositary Receipts (DR) of listed companies included in the SEM All Share Index (SEM-ASI). On 12th September 2016, the SEM Volume Weighted Average Price (SEM-VWAP) index started at the same level of the SEMDEX on 9th September 2016.

SEM Bond Index (SEM-BI) comprises rupee and foreign-currency denominated debt instruments that are listed and traded on both the Official Market and the Development & Enterprise Market (DEM) and excludes structured debt products, zero coupon debt instruments and debt instruments that have a maturity of less than one year. It is a market capitalization based index. Market capitalization of the underlying debt instruments is based on last traded prices.

The DEMEX is a capital-weighted index which tracks the price weights of the shares listed on the DEM, whilst the DEMTRI is a total-return index for the DEM market.

Launched by the SEM on 08 September 2015, the SEMSI tracks the price-performance of those companies listed on the Official Market or the Development & Enterprise Market which demonstrate strong sustainability practices. SEMSI provides a robust measure of listed companies against a set of internationally aligned and locally relevant environmental, social and governance (ESG) criteria. It offers a useful tool for domestic and international investors with an appetite for responsible investment in frontier markets.

Shares, also referred to as equities or stocks, represent ownership of a company along with other shareholders. When you buy shares in a company, you are buying a part of that company. Ownership of a company’s share entitles you to a proportion of a company’s profits which can be given to you as dividends. Another form of return relates to the increase in the price of the company’s shares called capital gains.

An investor can acquire shares in two ways:

- Through the purchase of shares on offer in an Initial Public Offering (IPO). The company uses the money received from selling these shares to develop their business.

- Through the purchase of shares on the Stock Exchange.

The simple answer is to build wealth. You can do this in two ways:

- buy shares at one price and sell at a higher price, and

- earn income in the form of dividends from your shareholding.

A share price goes up because people value the shares in that company and offer increasingly higher prices to buy them. This may sound simple, but there is no guarantee shares will rise in price while you own them. The big risk of investing in the sharemarket is owning shares in a company that fails and its shares become worthless

There is no required minimum. A minimum of 1 share in a listed company needs to be purchased.

Transaction fees are on page Transaction Fees – Stock Exchange of Mauritius. In terms of payment, your investment dealer is your best answer to this question. In general, you may transfer funds directly to the bank account of your investment dealer or send your investment dealer a cheque in favour of the company's name; while investment dealers do also accept cash, there are KYC restrictions and would require added information with regards to its source.

Dividends and capital gains for investors on SEM

There is no tax on dividends paid by a company listed on the Stock Exchange of Mauritius or by a subsidiary of that company.

There is no tax on gains or profits derived from the sale of units or of securities listed on the Official List and the Development & Enterprise Market of the Stock Exchange of Mauritius.

Foreign investors on SEM

There is virtually no restriction on foreign investment in companies listed on the Stock Exchange. Foreign investors do not need approval to trade shares, unless investment is for more than 15% in a sugar company. Foreign investors benefit from numerous incentives: revenue on sale of shares can be freely repatriated, and dividends and capital gains are tax-free.

That is the million dollar question. The answer is not straight forward, and depends on your risk appetite, return expectation and investment time frame. Your investment dealer provides regular in-depth fundamental analysis and valuations of select listed companies; however, prevailing market conditions can supersede fundamentals.

Ordinary shares, preference shares, debt securities, rights, depositary receipts, ETFs , corporate debentures ,bonds approved for issue by the Financial Services Commission, units issued under a unit trust approved scheme, Treasury bills and Government securities.

The value of the shares of listed companies is often related to their financial results and performances. The more profits a company makes, the more investors are willing to buy its shares. As share prices respond to the law of demand and supply, the share price of good-performing companies tend to go up over time, while those of bad-performing companies tend to drop over time.

Share prices also react to other factors such as interest rate movements, macro-economic data and international economic news. Markets react speedily and unpredictably to rumors of war, government changes, public sentiment and opinion. Prices can rise as quickly as they fall. You may not be able to predict these forces, but by analysing and understanding them, you may be better equipped to face market swings.

In order to trade on SEM, you should open a securities (CDS) account with a licensed investment dealer, i.e. a stockbroking firm. The licensed broker will be your main point of contact and will do the needful with regards to all your KYC requirements. A stockbroker is a well qualified person who buys and sells securities and offers investment advice to investors. Investors have to go through one of the stockbroking firms licensed by the SEM, in order to be able to invest on SEM. To contact a licensed investment dealer (stockbroker), please click here.

SEM has a mobile app, mySEM, providing investors seamless access to a wide variety of key listed company data in real time, including company specific order books, highs and lows, five best bids and five best asks, and other relevant company-specific data.

The mySEM mobile app also allows investors to have online access to their CDS accounts to monitor their account activity and account status. mySEM also allows investors to place orders online with their stockbroker (s).

Prior to registering as an mySEM User, you should have a CDS Securities Account opened through an Investment Dealer.

- In the long term, share prices generally increase and investors can sell them for more than what they had paid for them, hence pocketing a capital-gain.

- Investors can receive income (dividend) from the companies who pay a portion of their profits to their shareholders.

A dividend is a share of a company's profit distributed out to shareholders. Dividend policies are company dependent and vary from year to year, making it an inexact science to estimate dividend pay-outs.

- Investing in shares is riskier than keeping your money in bank deposits- share prices go up AND down. Hence your risk appetite is a first factor to consider before investing.

- Unexpected happenings in the global or local economy or in a particular company may result in share prices suddenly increasing or decreasing.

- Although stockbroker or asset management advice is a very important tool in investing, the final investment decision lies with you.

Risk is the possibility of losing part or all of your initial investment or the likelihood of making a profit that is less that what you anticipated.

Like any other investment, share investment carries an element of risk as share prices fluctuate as economic and market conditions change. Investing in shares is riskier than investing in bonds or depositing cash in the bank. More conservative investors are generally prepared to ride out temporary slumps knowing that, over time, prices are likely to increase again.

Before venturing into the market, confirm whether you have a lump sum for shares or if you will pay monthly installments for your stock market investments. It is desirable to set objectives before committing your savings to share investment:

- Is income a priority, or are you looking for long-term capital growth?

- What is your personal risk profile?

- How much can you safely afford to lose in the event of a stock market downtrend?

- How long will you be prepared to wait for the market to stabilize?

Your answers will determine the extent of your capacity to balance risk with reward. Either way, the golden rule is to invest only as much as you can comfortably afford after meeting your personal and household expenses.

- Be sure not to invest your money in only one security but rather invest in a variety of securities. This process is called diversifying. By diversifying you spread your risk across a range of sectors, companies and products. A loss in one security can be reduced by the profit in another security. The popular saying “don’t put all your eggs in one basket” can apply to many things but it applies particularly well to investing in the sharemarket. Markets move in cycles. Some investors fall into the trap of putting all their money into one asset class or sector – usually at its peak, and then watch as another asset class or sector takes off without them (an asset class is an investment type like shares or property and a sector is a particular investment area like shares in banks or mining companies). It is better to diversify, spreading your risk. The sharemarket is one asset class and there are different sectors within the sharemarket you can use to diversify your portfolio. A sound investment portfolio usually includes investments with a combination of different features. For example, you might hold some investments that you can convert to cash easily and some you are happy to have locked away for a period of time.

- Broaden your knowledge by regularly reading financial literature; attending financial courses and seeking qualified investment advice.

- Only invest the money that you feel you can afford to lose.

Investing on the stock market provides you with one of the various opportunities to achieve your long-term financial goals. It is advisable that you invest the money that you can afford to live without for a relatively long period of time. Your investment needs time to grow. The amount of money you choose to invest on the stock market depends on your age, your risk profile, your investment objectives, the amount of savings you have set aside and that you may not need and the proportion of that saving that you are willing to commit to shares. If you have any doubt about how to allocate your savings among different types of investible assets you may need to contact a financial adviser.

Although past performance is no indication of future performance, historical data on SEM indicate that investments in many listed companies have, over the long-term, outperformed many other types of investments and provided annualized total returns in excess of inflation.

Investing in shares can also be used as a diversification strategy which allows you to place your savings in different saving options, thereby, spreading your risk and avoiding to keep all your savings in one basket.

Buying shares through stockbroking firms affords investors protection, as these firms are required to conform to SEM rules and regulations.

Investors should remain updated on the market and companies whose shares they own. Stockbrokers can assist in explaining market behaviour, however, some of the factors responsible for growth or decline in share prices such as, company profits, growth in the local economy and international economics, are easy to follow in the press and on SEM's website. It is always advisable to invest savings and not borrowed funds, and to invest in businesses you understand.

Lastly, again get educated on the subject of stock market investment, and after going through this booklet, please explore other publications available on SEM's website. There is also a wealth of financial literature available free on the internet, besides stock market articles in local newspapers and magazines as well as research papers by your stockbroker. Last but not least, speak to your stockbroker and /or financial expert for any advice before investing.

The Central Depository and Settlement Company Ltd (CDS) came into operation in 1997. The CDS is regulated through the Securities (Central Depository, Clearing and Settlement) Act 1996, the Rules and Procedures. The CDS has been designed according to IOSCO standards. The fundamental concept of Delivery versus Payment is implemented on a rolling T+3 basis with the Bank of Mauritius (BOM) acting as the Clearing Bank (as stipulated in the CDS Act).

Once the BOM confirms that funds settlement has occurred, the CDS transfers the shares between the securities accounts of the respective clients.

| Price Range | Tick Size |

| < 5.00 | 0.01 |

| >= 5.00 < 10.00 | 0.02 |

| >= 10.00 < 50.00 | 0.05 |

| >= 50.00 < 500.00 | 0.25 |

| >= 500.00 < 1000.00 | 1.00 |

| >= 1000.00 | 5.00 |

- The tick size of ETFs and Depositary Receipts will be 0.01

If there is a security delivery failure a buy-in will be initiated with the defaulting broker having to put up 50% of the value of the transaction, to be used to compensate the buyers who will be paid an amount equal to 50% of the difference between the price originally paid and the price at which the stock was subsequently sold. A further 15% will be paid on undelivered stock after 5 trading sessions since initiation of the buy-in.

If there is a funds settlement failure, the Guarantee Fund will make good the obligations of the defaulting investment dealer. There has never been any failed trade on the Mauritian stock market.

Cross trades are allowed, provided certain specific conditions are satisfied. Only transactions with a value greater than MUR 10m or >2% of the issued quantity of the security can be crossed. Crossings are permitted within the allowable price spread of the security. Crossings can only occur between one buyer and one seller. No split trades are allowed on the crossing board price.

Trades are settled at 10:00 (GMT+4) on the third business day following the trade. ie generally your investment dealer would require that the funds be in its accounts by latest . T+3 @ 10am

After execution, your investment will generally mail you a crossed cheque - unless otherwise specified - on T+3

A given share's market price is the last price at which the stock traded on the normal board, ie in bundles of 100 shares.

Yes, it is possible to buy or sell shares at market price; however, this may require patience as there are others in the queue ahead of you waiting to buy/sell. Alternatively, buyers and sellers may have placed their respective bids and offers at lower or higher than market prices.

The share certificate is proof of share ownership issued by the company itself. Given that it is a physical item, it can be damaged, lost or destroyed. It is recommended that you deposit the share certificate with the CDS just like you would place your money at the bank.

If you wish to sell the shares, your investment dealer will assist you with the opening of a CDS account in the name of the Estate and the deposit of share certificates. Your investment dealer would require authorization of all heirs to proceed and the proceeds from the sale would be made in the name of the estate. Should you wish to distribute the shares, your investment dealer will assist you with the withdrawal of shares from CDS. Your notary would then have legal authority to evenly distribute shares to every heir, and new share certificates would then have to be issued by the company. Once the new shares certificates have been issued, your investment dealer will help you re-deposit the stocks with the CDS.

The maximum total brokerage fees will stand at 1.25% of the value of the trade. This fee includes Brokerage charges, SEM fees, CDS fees, and FSC charges.

You may start trading immediately as soon as your CDS account has been opened.

Also referred to as a "Bought Note" or "Sold Note", the contract note, is your official receipt and legal proof that you have purchased or sold the given securities.

Once you open your account with your investment dealer (stockbroking company) and signed the client indemnity agreement, you will be able to place your transaction orders with us either in person, by telephone, email, fax, or by text message (as authorised by the indemnity agreement). Upon receiving your order we will place it on the SEM's Automated Trading System (ATS) and its execution should in most cases be instantaneous, although it may at times take several days to complete. Once the trade is effected, your investment dealer will promptly send you a trade confirmation together with the applicable contract notes. Settlement is generally effected by cheque or bank transfer on the third day following the trade (i.e. termed as T+3). Hence, after effecting a purchase transaction, you will be required to settle your payment at latest 3 days after the trade. Similarly, when a sale is effected, your investment dealer will reciprocate by having settlement payments made over to you on T+3.

Yes, it is possible for you to buy or sell shares on the SEM in any amount and quantity. There are two automated stock trading boards on the SEM : the 'Main' and the 'Odd lot'. The Main board allows buying and selling of shares to take place in multiples of 100. On the other hand, the trading of between 1 and 99 shares requires the use of the Odd Lot board. Pricewise, any order must fall within the daily spread of the market price (i.e. 20% below or above).

To ensure that an order is placed to your requirements, it is recommended that you include the following details with your order:

Your CDS Securities Account No;

The type of your order (i.e. 'Buy' or 'Sell'; 'Market' (i.e. at Market Price) or 'Limit' (i.e. with a specified Price limit);

Any price limit you wish to put to your order. If you do not specify any price limit, your order will be executed instantaneously at the best available offer/bid on the market. However, if you do set a price limit, your order will be placed on the ATS at the specified price and will be added to the queue;

Volume i.e. the total number of shares that you wish to purchase (or dispose of). Unless specified, orders will be executed in the SEM's default minimum parcel size of 100;

Block limits. Should you wish to dispose of (or purchase) shares in minimum 'blocks' of 100 or greater, you will need to specify your minimum quantity;

A validity period to your order. i.e. for what duration (in days) you want your order to remain valid. The minimum validity is one day and the maximum is 30 days.

When a client gives an instruction to his stockbroking firm to buy or sell a particular stock, the broker will enter the order on his terminal. The order will instantaneously be routed electronically to the Stock Exchange. The Automated Trading System automatically matches the orders against each other, resulting in trades. The Automated Trading System records the sale price, quantity, buyer and seller and time of the trade. Trades that are executed by the Automated Trading System are known as on-market trades.

Orders entered into the Automated Trading System are matched under the supervision of the SEM. The order book maintained by the Automated Trading System for each security is divided into bids and offers and prices are determined and trades effected in accordance with specific rules depending on order parameters set out in the Trading Procedures.

Under the Automated Trading System, the market goes through a number of different phases to allow for various activities, such as establishing opening prices and end of day processing. Trading is divided into four main sessions, each with its own operating hours as indicated in the table below.

Official Market

| Sessions |

Time |

|

Pre-opening |

9.00 a.m. to 10.00 a.m. |

|

Opening |

10.00 a.m. |

|

Continuous |

10.00 a.m. to 13.30 p.m. |

|

Closing |

13.30 p.m. |

Development & Enterprise Market

| Sessions |

Time |

|

Pre-opening |

9.00 a.m. to 10.00 a.m. |

|

Opening |

10.00 a.m. |

|

Continuous |

10.00 a.m. to 13.30 p.m. |

|

Closing |

13.30 p.m. |

During the pre- opening session, the system accepts orders. Orders can be amended and cancelled but no execution of trades takes place during this stage.

During the opening period, the opening price of each security is calculated by the system. The system also carries out the opening matching of trades and reports the trades accordingly.

During the continuous phase normal trading operations occur. A stockbroker can enter or modify clients' orders but this may entail clients losing their price time priority as a result of such amendments.

The closing session is a short session after the end of the continuous trading. During this session the system would essentially compute the closing prices for each security. The closing price of a security is its last execution price. No orders can be entered after the closing session. Entering of orders recommences at 9 00 am on the next trading day.

An order input into the ATS and displayed in the order book can, if required, be either cancelled or amended by a trader.

An order can be cancelled at any point in time prior to execution. If partially executed, any unexecuted portion of an order can be cancelled.

As regards amendment of orders, an order displayed in the order book can be amended prior to execution. The order can be amended in respect of price, volume and time attribute. However, some attributes such as Client ID, Security ID and order type (buy/sell) cannot be amended.

Orders may be entered direct into the Automated Trading System via the terminal of an authorized Automated Trading System Operator (a stockbroking company) or via the iNet functionality contained in the website of the SEM.

Any order input by an Automated Trading System Operator is duly validated and time-stamped. An order ID is allocated. The ID will be sued for all future references to the order.

Order entry instructions include security Code, Client Securities Account, Bell or Sell indicator, Volume or Quantity, Price, Type of Order and Order Attribures.

There are two main types of orders, namely limit orders and market orders which can be placed in the Automated Trading System.

A limit order is one which specifies the maximum buying or the minimum selling price. The volume of order must be indicated. The ATS will attempt to match the order until either the entire volume is matched or no further matching is possible within the limit price.

A market order is defined as an order to buy or to sell a security at the best price prevailing on the market at that point in time. No price is specified for this type of order, but volume must be indicated. The main advantage of a market order is the fact that market orders have first priority. (Price is given the highest priority in the system). The market order goes immediately to the top of the queue and executes the trade leaving all the limit orders behind. Thus, market orders stand a better chance of execution.

Limit orders can have three order attributes, namely "Qualifiers", "Time in Force" and "Disclosed/Hidden Quantity".

Order qualifiers modify the execution conditions of an order based on volume, time and price constraints.

Time in force limits the life time of an order in the order book. If an order does not indicate a time condition, it is only valid for the business day on which it was input. There are two types of time in force attributes, namely "Good Till Cancelled (GTC)" and "Day Order". GTC means that the order remains valid till cancelled within 30 days from the day on which it was input and is automatically cancelled by the system on the expiry date. On the other hand a day order is one which is valid until the close of the trading day and is automatically cancelled at the end of the trading day.

The disclosed quantity attribute reveals the order size and will cause execution to occur in blocks of disclosed quantity. The hidden quantity will not be visible to the market.

There are strict regulations governing order priorities. Orders are queued and traded according to price-time priorities. Better-priced orders trade first. If there is more than one order at the same price, the order that was placed first has priority.

Whether an order trades or not depends upon a number of factors, namely:

- whether there are buyers or sellers willing to trade at the same price

- the quantity of securities being ordered

- the order type

A crossing is a trade between two stockbroking companies or a trade between the same stockbroking company for a specified quantity of securities at a specified price. For securities traded on the equity board and debt board crossing is carried out during the continuous session of the operating hours of the ATS.

Other factors could be dividends and other entitlements, takeovers and trading halts.

Securities trade upon the basis that they are entitled to upcoming dividends, rights issues, etc. If this basis changes, the security price generally also changes. Any such changes are displayed on the Automated Trading System.

Takeovers and schemes affect the price of a security and what types of orders can be placed.

The Stock Exchange operates three types of markets, viz: the Official Market, the Development Enterprise Market, the Debt Market.

The Official Market comprises of Equity Board, Odd Lot Board and Special Terms Board.

The Development Enterprise Market comprises of Equity Board, Odd Lot Board and Special Terms Board.

The Debt Market comprises of Debt Board and Crossings Board.

The Equity Board is meant for trading of listed ordinary shares and preference shares. Trading unit will be in multiples of 100 securities subject to a minimum of 100 securities.

The Odd Lot Board is designed for trading of listed ordinary shares and preference shares whose buy and sell orders have quantities less than 100 securities. Trading unit will be one security subject to a maximum of 99 securities. Odd lots trading cycle consist of continuous session only.

The Debt Board is for the trading of corporate debentures & bonds and government securities.

The Special Terms Board is designed for undertaking specific types of trades as and when the need arises based on market requirements. It in turn consists of the All or None Board, Crossing Board and Buy-In Board

“Odd Lot Board ” - the permissible trading quantity on the Odd Lot Board is less than 100 securities and is accepted in multiples of one security.

" Normal Board "- for the trading of listed ordinary shares and preference shares. Trading unit will be in multiples of 100 securities subject to a minimum of 100 securities. Securities denominated in local and foreign currencies will be traded on this board.

A crossing is a trade between two stockbroking companies or a trade between the same stockbroking company for a specified quantity of securities at a specified price involving only one buyer and one seller. For securities traded on the equity board and debt board crossing is carried out during the continuous session of the operating hours of the ATS.

The AON Board is a bid/offer of a specific quantity of securities which will be matched to a best contra order at the close of the 3rd market day from the day the initial bid/offer is input in the Automated Trading System in respect of securities traded on the equity board, debt board, DEM board. AON transactions will be invoked from a separate board.

Buy-In session is organised by the Stock Exchange upon receipt of request from CDS, in case of default by CDS participants to deliver securities traded on the equity board, debt board, DEM board on the settlement date. Buy-In is carried out on the buy-in board.

A trading halt is a surveillance mechanism in-built into the Automated Trading System during which period no exchange of transactions may take place. A trading halt may be imposed during one or more trading days. The Automated Trading System contains a system via which the Stock Exchange will inform the market of trading halts.

There are two types of trading halts, namely market halt and security halt.

- Share investment is only for rich and famous; the fact is, share investment is for everyone who wants to invest in the market and has disposable income or savings.

- To invest in shares, an investor needs to have a high level of education; you are not required to have any form of formal or specialised education to invest and grow your savings. However, investors could do well by following events in the stock market and news about the companies they have invested in.

- An investor can make a good profit over night

- Stock market investment is about long term investment.

- It is essential that you do research before buying any shares on the market. Understand how money is made from share investment and regularly review your return on investment.

- Be an information-hungry shareholder and strive to know more about the companies whose shares are in your portfolio.

- Invest in what you know and increase your knowledge by reading financial publications regularly. Reports about listed companies and other financial articles which influence the performance are often published in these publications.

- Do not borrow in order to invest. The money used to buy shares with should not be needed in the short term. Exercise patience, but do not get married to your share.