Calculation

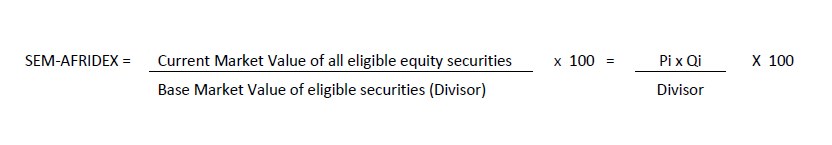

The Index formula is as follows:

where Qi is the number of shares / DRs issued by the eligible security and Pi is its closing price.

MENU

The SEM-AFRIDEX tracks the performance of listed equity securities on the SEM that have a focus on the African continent (except Mauritius).The SEM-AFRIDEX was launched at 100 points and includes all listed and traded equity securities on the Official and Development & Enterprise Market that meets the index eligibility criteria.

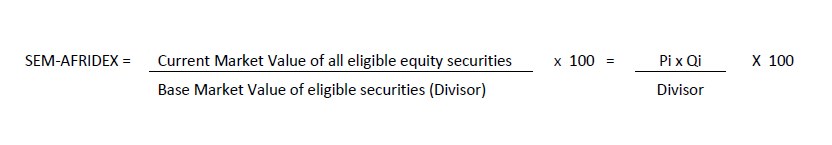

The Index formula is as follows:

where Qi is the number of shares / DRs issued by the eligible security and Pi is its closing price.

To be eligible for inclusion in SEM-AFRIDEX, a company can be incorporated either in Mauritius or in an acceptable foreign jurisdiction.

Focus on the African Continent

Only securities of companies, which have a focus on the African Continent, shall be eligible for inclusion in the Index. The Geographical focus shall be as follows:

Market Capitalisation

Only securities with a market capitalisation of at least USD 1 Million shall be eligible for inclusion in the Index

Where a company’s equity shares are issued partly paid and the call dates are already determined and known, the market price, for calculating its market capitalisation, is adjusted to include all such calls (i.e., the fully paid price).

The key to the maintenance of the SEM-AFRIDEX is the adjustment of the divisor. Index maintenance, reflecting changes in shares outstanding, corporate actions, additional or removal of stocks to the index, should not change the level of SEM-AFRIDEX. Any change to the constituents of SEM-AFRIDEX that alters the total market value of the index, while holding stock prices of the constituents constant, will require a divisor adjustment.

There is a large range of corporate action ranging from routine share issuances or buy backs to more complex events like spin-offs or mergers. Some of these changes are listed below with notes about whether the divisor is adjusted.

Divisor (t) = [Divisor (t-1)] * MV (t)

MV (t-1)

Divisor (t) = Divisor level post corporate action

Divisor (t-1)= Divisor level prior to corporate action

MV (t) = total market value post corporate action

MV (t-1) = total market capitalisation prior to corporate action

| Corporate Action | Comments | Divisor Adjustment |

|---|---|---|

| Company added/deleted |

Net change in market value determines the divisor adjustment. |

Yes |

| Change in shares outstanding |

Any combination of secondary issuance, share repurchase or buy back – share counts revised to reflect change. |

Yes |

| Stock split |

Share count revised to reflect new count. Divisor adjustment is not required since the share count and price changes are offsetting. |

No |

| Spin-off |

If the spun-off company is not being added to the index, the divisor adjustment reflects the decline in index market value (i.e., the value of the spun-off unit). |

Yes |

| Spin-off |

Spun-off company added to the index, no company removed from the index. |

No |

| Spin off |

Spun-off company added to the index, another company removed to keep number of name fixed. Divisor adjustment reflects deletion. |

Yes |

| Special Dividend |

When a company pays a special dividend the share price is assumed to drop by the amount of the dividend; the divisor adjustment reflects this drop in index market value. |

Yes |

| Rights offering |

Each shareholder receives the right to buy a proportional number of additional shares at a set (often discounted) price. The calculation assumes that the offering is fully subscribed. Divisor adjustment reflects increase in market cap measured as the shares issued multiplied by the price paid. |

Yes |

If a constituent issued new shares in the current period which were not present in the previous period, the index algorithm subtracts newly issued capitalisation from total capitalisation in the current period. This equalises the number of shares in both periods so the SEM-AFRIDEX reflects only price changes.

A cancellation of shares by a constituent is treated as a negative new issue. Shares created by the conversion of other securities are treated as new issues.

When shares begin trading ex-rights, the theoretical share price falls by the intrinsic value of the rights. Because the SEM-AFRIDEX follows only the shares and not the rights, which may be traded separately, an adjustment is needed to prevent the index from dropping. The method is similar to that of a new issue. In both cases, the theoretical price is the weighted price of the shares at the instant after the change.

Dividend in specie (in kind) means dividends not paid in cash. Such dividends are paid out in the form of assets / securities of companies owned by the issuer and are in a given amount.

The number of shares created by the bonus issue or stock split is used to adjust the shares outstanding at the ex-bonus/split date. Similarly, a reverse split is recorded as a negative stock split while reducing the shares outstanding by the amount of the negative split. In the case of stock splits, as prices drop by the split ratio, total capitalisation does not change at the time of the split and no adjustment to the SEM-AFRIDEX is needed. Stock dividends, also known as bonus issues, have the same effect as splits and no adjustment to the SEM-AFRIDEX is therefore needed.

Cash dividends can affect share prices, but the industry norm is not to make any adjustment for such dividends in the SEM-AFRIDEX. Cash dividends on a per share basis are recorded at the ex-dividend date, using gross cash dividends.

In the event that a security is suspended, the constituent may remain in the SEM-AFRIDEX, at the price at which it is suspended, until suspension of dealing is removed.

If an amalgamation (merger), Restructuring or Takeovers results in one security being absorbed by another constituent, the resulting company shall remain a constituent of the SEM-AFRIDEX.

If a constituent company is taken over or absorbed by a non-constituent company, the original constituent shall be removed.

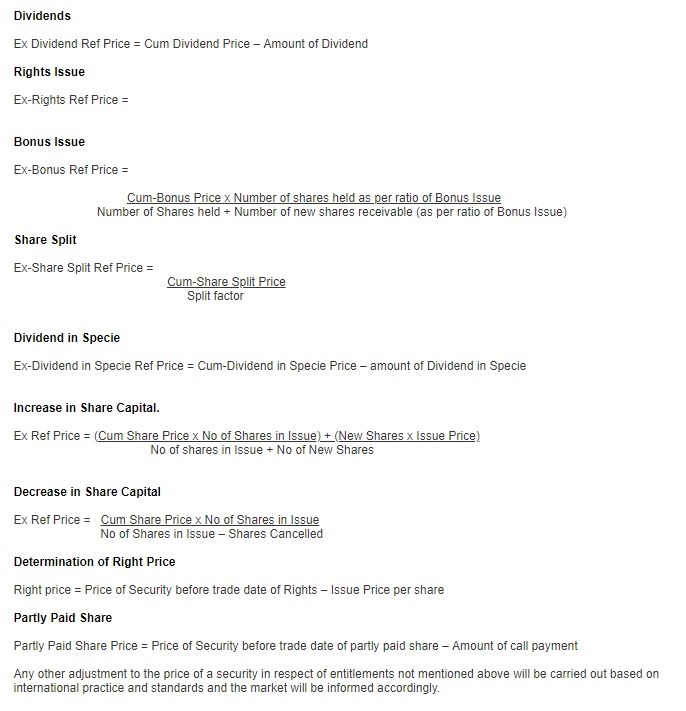

On Cum-date following close of Market the reference price of the security is adjusted to account for the Corporate Actions: Dividends, Rights Issue, Bonus Issue, Share Split, and Dividend in Specie. The Ex- reference price is adjusted to reflect its tick size as per the ATS Procedures. The price spread for the next session is based on the Ex- reference price.