MENU

- About Us

- Products & Market Data

- Listing & Issuer Services

- Education & Investor Services

- Regulations & Governance

- CDS

- Contact

indices

- Home

- •

- Products & Market Data

- •

- indices

- •

- SEMTRI

SEMTRI

The Total Return Index, the SEMTRI, is an index, which tracks the price performances of the constituents of the SEMDEX and ensures that the dividends paid by these constituents are reinvested. Its main purpose is to provide domestic and foreign market participants a good measurement of total return which combines both price movements on listed stocks and dividends obtained on these stocks since the inception of the local stock market on July 5, 1989. As from 12th September 2016, the SEMTRI is based on the constituents of the new version of SEMDEX, which will be comprised of Mauritius-rupee denominated constituents only. The SEMTRI opened the session of 12th of September at its closing value of 9th September 2016.

Calculation of SEMTRI

The methodology used for the calculation of the Total Return Index is based on the following approach.

The calculation is undertaken in two steps:

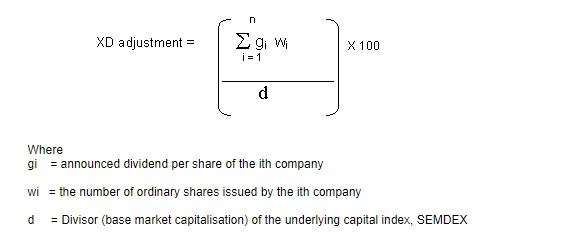

1) The first step is to transpose the total daily announced dividend payments into index points on the ex- dividend date. This is called XD adjustment to the underlying capital index, i.e the SEMDEX.

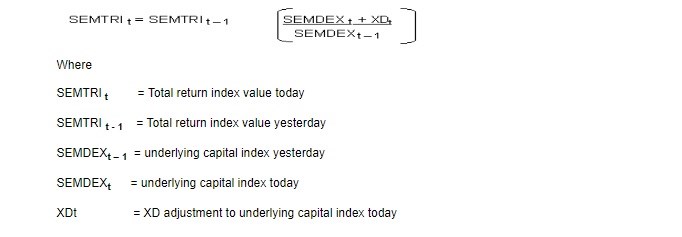

2) The second step of the calculation uses the figures calculated in step one (XD adjustment). These figures are included in the formula below to calculate the SEMTRI, assuming re-investment of gross dividends.

Rules for the maintenance of the SEMTRI

The maintenance of and operational adjustments to the SEMTRI in respect of corporate events, such as new listings or delisting, rights issues, bonus issues etc will be done in accordance with the rules governing the maintenance of the underlying capital index, SEMDEX.

Advantages provided by SEMTRI

SEMTRI provides investors with the following benefits:

- It constitutes a very good indicator of the performance of the overall stock market and provides a dynamic yardstick of the local stock market’s evolution overtime.

- It captures the two forms of return that a stock market investment generates, namely, capital appreciation and dividend payments.

- It will provide investors, in general, and long-term institutional investors, in particular, a useful benchmark to undertake cross-market and cross-instrument performance measurements.

- It will enable the SEM to regularly publish the list of top performing companies in terms of capital growth and dividend payments.